PrinSIX and Welcom – Together we create an end-to-end digital experience

Credit providers want better quality customers, with an economic model that provides a balance between compliance and commercial objectives, focusing on customer outcomes and the ability to understand the future value of customers whilst managing regulatory risk. Consumers need new and better value products that the borrower can trust and are accurate, customer journeys that establish a continuous improvement approach driven by real-time actionable insights so that you can quantify the risk associated with each customer.

PrinSIX is partnering with Welcom to transform customer acquisition and onboarding, specifically, the piece between ‘Apply Now’ and ‘You Have Been Approved’, so that credit issuers, risk, compliance and underwriting processes are aligned and provide better outcomes for borrowers. PrinSIX

- Orchestrate dynamic conversations that adapt to every applicant as more is learnt, – configured, not coded – resulting in better outcomes at lower risk

- Personalise customer journeys, minimising abandonment by delivering an improved customer experience

- Equip organisations to act on new insights, captured by tracking applicant behaviours in real-time customer journeys and being able to evidence lending decisions whilst Treating Customers Fairly

The future of lending is now. Personalise your onboarding today

With PrinSIX, onboarding stops being a ‘one size fits all' process and moves to being a digital conversation. Analytics is no longer passive but controls the conversation.

It asks what needs to be asked. It probes.

It investigates.

It questions, either directly with an applicant or via APIs to external 3rd party services.

It watches what people do and creates insights from behaviours as well as answers.

It predicts and aligns the business to FCA regulation and practices.

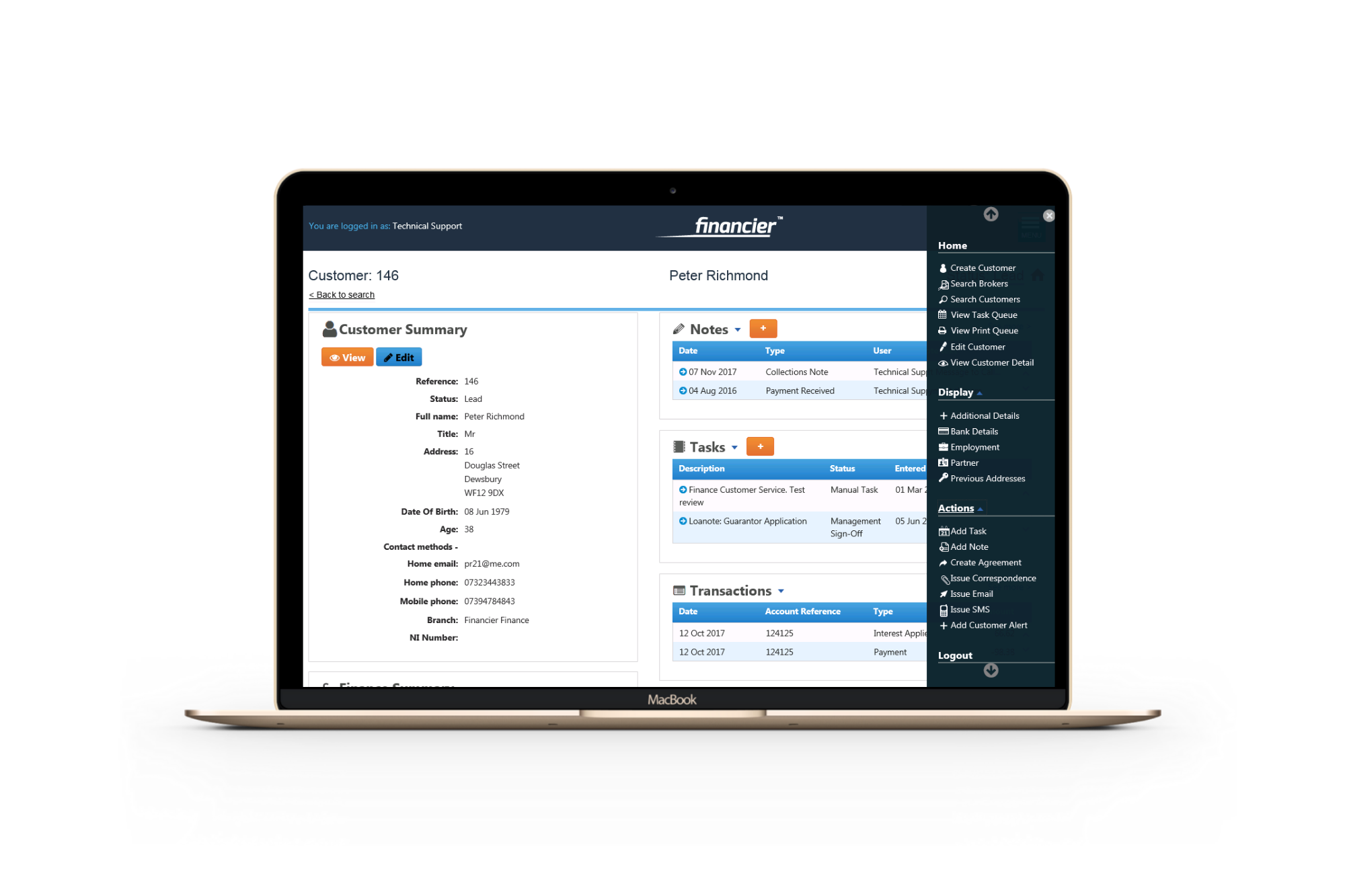

Welcom's loan management system, Financier™ automates the entire loan lifecycle.

It provides a comprehensive web-based platform for consumer and commercial credit issuers providing financial products including unsecured, secured and line of credit in a single, scalable solution. With automated decisioning, appropriate products can be offered based on affordability and vulnerability.

Combining Welcom Digitals Loan Management with PrinSIX brings a new standard in the ability of lenders to balance commercial loan opportunity with compliance risk; always delivering the best outcomes for customers and your business.

Key features:

- API First approach

- Low code, no code configurable options

- Impactful Commercial Benefits

- Demonstrable Business Case

Welcom Digital Limited

The Exchange

Station Parade

Harrogate

HG1 1TS

T 0845 4565859

F 0845 4565253

Office hours9am to 5.30pm Mon to Fri